The real estate landscape in the UAE is undergoing a quiet revolution. As sustainability moves from niche to norm, eco-friendly and “green” properties are rapidly becoming the preferred choice for both investors and end-users. What used to be a “nice-to-have” feature is now becoming a key determinant of property value, long-term performance, and market desirability.

The Drivers Behind the Green Shift

Several converging forces are fueling the surge in demand for sustainable real estate in the UAE: government policies, shifting consumer preferences, rising environmental awareness, and evolving economics of owning property.

- National sustainability agendas. The UAE has set ambitious targets through initiatives like the Dubai Clean Energy Strategy 2050 and the broader UAE Net Zero by 2050 Strategic Initiative — which push for significant reductions in carbon emissions and a transition to clean energy sources.

- Regulatory and financial incentives. Developers of green-certified projects often benefit from faster approvals, reduced fees, and other regulatory advantages. At the investor side, “green loans” or sustainable financing options — sometimes Shariah-compliant — are increasingly available, reducing the cost of capital for eco-friendly projects.

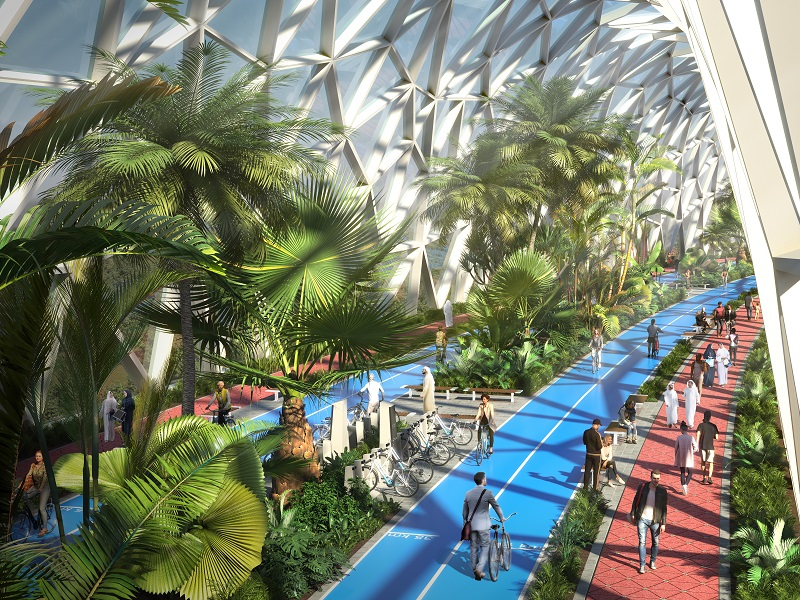

- Changing buyer and tenant preferences. More residents — especially younger families, expatriates, and environmentally conscious buyers — now prioritize energy efficiency, lower utility costs, healthier indoor environments, and sustainable-lifestyle amenities.

- Operational and long-term cost benefits. Sustainable buildings — with features like solar panels, efficient HVAC systems, smart lighting, water-saving fixtures and recycled or low-carbon materials — lead to substantial reductions in energy and maintenance costs over time.

Together, these drivers create a powerful foundation for sustainable real estate to outpace traditional developments in both demand and value.

Why Green Properties Deliver Higher ROI

🏡 Premium Pricing, Resale Value, and Rental Yields

Properties built to green standards — or with certification — tend to command higher prices on sale and rent. For instance:

- Green-certified buildings can command rental premiums of 6–9% compared to conventional buildings, reflecting growing tenant demand.

- Some studies and market reports indicate that “green” homes and offices often sell or resell at price premiums of 10–15% over comparable non-green properties.

- Demand for sustainable homes continues to grow, and buyers — particularly expatriates and eco-conscious residents — are willing to pay more for long-term savings, healthier living, and reduced environmental impact.

That premium is not just about “feeling good” or “lifestyle bragging rights” — it translates into real financial gains.

💡 Lower Operating & Maintenance Costs — Improving Net Yield

Sustainable or green buildings are often significantly more efficient in their energy and water use, which means lower utility bills for residents, and lower operating costs for landlords.

- Compared to conventional buildings, green architecture can cut energy bills by 20–30%.

- Over time, savings on electricity, water, and reduced maintenance costs (thanks to better design, materials, and systems) improve the net operating income of a property — effectively raising the yield for investors, especially those renting out the property.

- The savings become more pronounced over the lifetime of the property — making sustainable homes especially attractive for long-term investors rather than short-term speculators.

📈 Reduced Vacancy, High Tenant Retention & Stable Demand

As more people — both locals and expatriates — become aware of the benefits of sustainable living, demand for eco-friendly properties is rising. This has implications for owners and investors:

- Green-certified residential and commercial properties lease faster and often have lower vacancy rates than conventional ones.

- Tenants typically stay longer in green buildings, in part because of lower utility costs, better living/working conditions, and perceived long-term value — enhancing rental stability and reducing turnover-related costs.

- For investors relying on rental income rather than quick resale gains, this stability and predictability of cash flow is a major advantage.

🔮 Future-Proofing: Resilience & Regulatory Compliance

Investing in sustainable real estate is increasingly about future-proofing. Consider:

- Energy efficiency, renewable energy integration (e.g. solar), smart water management, and sustainable materials help properties comply with evolving regulations — reducing the risk of obsolescence.

- As national targets progress (e.g. clean energy, carbon reduction), demand will likely increase for “green” over “grey” properties — and investors who bought early or in certified developments stand to benefit more.

- Sustainable buildings also tend to hold value better during economic or regulatory shifts that penalize high energy-consuming or environmentally unfriendly structures.

Real-World Examples & Market Trends

Several projects and market studies highlight how sustainability is already translating into value across the UAE:

- Developments like Tilal Al Ghaf and Dubai South reportedly offer 6–8% rental yields and sell at price growth rates above average, propelled by energy-efficient designs and smart infrastructure.

- In master-planned green communities, villas have shown significant appreciation, and demand for such properties continues to rise among families and expats who value sustainability, comfort, and long-term savings.

- According to real-estate analysts, green-certified buildings — especially those certified under frameworks like LEED — have started commanding rental and resale premiums, and delivering better returns to investors compared to non-certified buildings.

Challenges & What Buyers Should Watch Out For

While the trend is strongly in favor of sustainability, it’s not without caveats. Investors and buyers should be mindful of:

- Higher upfront construction costs. Green buildings often require higher-quality materials, energy-efficient systems, and additional certifications — increasing the initial price. Over time, these costs may be offset by savings and premiums, but investors need patience and a long-term horizon.

- Awareness and education gap. Not all buyers (especially those used to traditional real estate models) immediately appreciate or value the long-term benefits of sustainability. In some cases, developers must actively educate buyers on the lifecycle advantages of green homes.

- Standards and “greenwashing.” As demand for green properties rises, some developments may market themselves as “green” without genuinely delivering on sustainability — buyers should check for legitimate certifications (e.g. LEED) and transparent documentation of energy/water efficiencies.

- Market premiums may vary by location. Not all areas or developments deliver equal returns — premium for green certification may be higher in more desirable neighbourhoods, while less central or less developed areas may see smaller spreads over conventional properties.

Why Sustainable Real Estate Fits the Long-Term Vision — For UAE and Investors

For the UAE, sustainable real estate isn’t just a niche market — it’s a strategic component of national development. As urbanisation intensifies, and environmental challenges (like heat, energy demand, water scarcity) become more pressing, green buildings and communities offer a way to balance growth with sustainability.

For investors — especially those looking for long-term capital appreciation and stable rental yields — green properties offer a compelling value proposition:

- They combine premium pricing, higher resale value, and solid rental yields with lower ongoing costs.

- They benefit from growing demand among environmentally conscious tenants, including expats and younger buyers.

- They are more resilient to regulatory changes, market fluctuations, and evolving global ESG standards — making them a safer long-term bet than traditional real estate.

Moreover, as sustainability becomes embedded in national strategy (clean energy, reduced emissions, sustainable urban planning), green-certified developments will likely gain even stronger advantages — both in financial returns and social value.

Conclusion: Sustainable Today, Profitable Tomorrow

The surge of sustainable real estate in the UAE is more than a trend — it’s becoming a structural shift. What was once optional is now fast becoming the preferred norm. For buyers, investors, and developers alike, green properties are delivering real value: higher returns, lower costs, better living conditions, and long-term resilience.

In a regional market known for rapid growth and dynamic changes, investing in sustainability isn’t just good ethics — it’s good business.

Whether you’re an investor looking for stable long-term gains, an expat seeking a sustainable lifestyle, or a developer planning the next project, green real estate in the UAE presents a compelling, forward-looking opportunity.

Leave a Reply